Columbus — Too many Ohioans are not saving for retirement. AARP/state-facilitated retirement plans and “Auto IRA” may offer new hope to those who have not saved enough.

A panel of experts, led by AARP host Jason Smith, met on Wednesday via Zoom to discuss the state’s impeding retirement crisis. It included Ohio Treasurer Robert Sprague, Anne Zimmerman, small business advocate and owner of Zimmerman & Co. CPAs and treasurer of the Anderson Area Chamber of Commerce (Hamilton County, Ohio), Angela Antonelli, executive director of the Center for Retirement Initiatives at Georgetown University, and David C. John, senior strategic policy adviser at the AARP Public Policy Institute.

The panelists discussed strategies to best prepare small business owners and their employees for a secure retirement.

According to Smith, “Retirement is a topic that many of us, especially younger Ohioans, may delay or put off as a future problem. But we have a retirement crisis problem right now impacting us across our nation. While Social Security is a critical piece of the puzzle, it alone is not enough to depend on. It was never actually meant to fully provide for retirement. It was created to ensure that Seniors would have a steady and guaranteed source of income when they retired.”

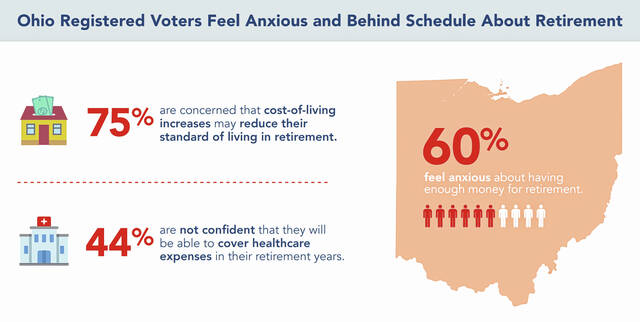

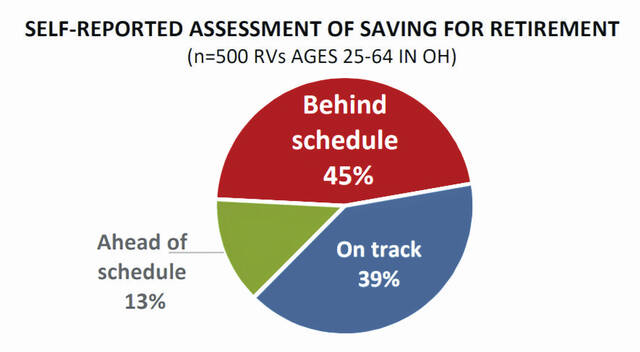

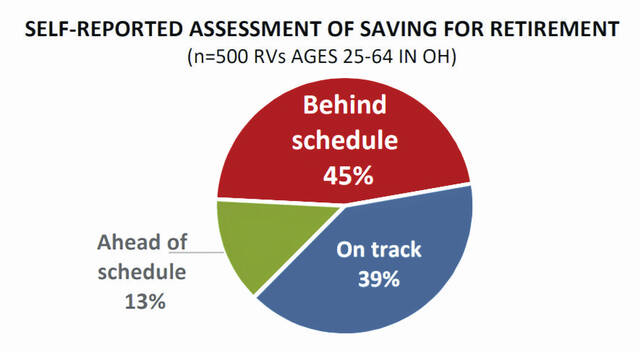

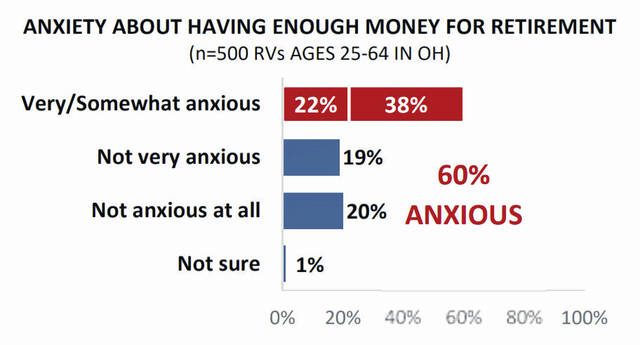

AARP’s research data from their “Vital Voices Survey” describes why Ohioans need to take action today.

At the start of the pandemic in 2019, 70% of small business employees in Ohio lacked an employer-based retirement savings plan.

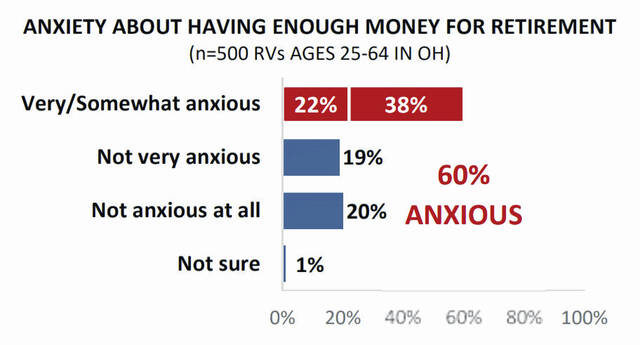

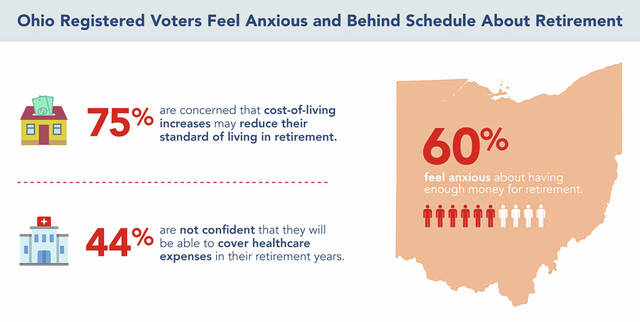

To investigate the issue, between Nov. 19 and Nov. 27, 2019, AARP conducted a study that found “well over half of all registered voters say they feel anxious about having enough money to live comfortably in retirement and are concerned about the negative impact of other expenses on their retirement savings, such as health care and cost of living expenses.”

The study’s results also showed “strong support” for creating a public-private state retirement savings option.

The AARP study collected its information through telephone surveys with a sample size of 500 individuals. Those selected for the survey were drawn from a list of 19,300 Ohioans, ages 25-64. The age and gender of the participants selected were weighted according to Ohio voter database statistics, in order to more closely reflect Ohio’s overall demographics. (Survey questions are available on the AARP website).

“The pandemic has shown how vital it is for Americans to have savings they can depend on,” said Smith. According to the survey, “nearly 1 in 10 Ohio residents aged 45+ tapped into their retirement savings as a result of the COVID-19 pandemic. Thirteen percent of them stopped contributing to their investments entirely.”

The pandemic, however, has exacerbated what was already an impending problem that showed Social Security is simply not enough for most individuals to cover living expenses at the current cost of living in the state.

“The average Social Security benefits for a 65+ Ohio family is only about $19,000 per year, while older Ohio families on average spend $23,000 a year on food, utilities, and health care alone,” said Smith.

This discrepancy is part of the motivation for AARP to bring together a panel of experts and policy makers in order to “have this important discussion now, as we look back on the lessons learned from the past two years and begin addressing his crisis head-on,” said Smith. All around the country, small business owners and employees are looking for ways “to rebuild their savings and prepare for a secure future.”

“Small businesses are the backbone of America’s economy. They employ 61 million people nationwide, and about 2.5 million in Ohio, which equates to almost 50 percent of all employees in Ohio,” said Zimmerman. Small businesses, she says, can be the leaders in economic recovery as we come out of the pandemic.

One specific challenge for them, however, is providing retirement benefits. For some small businesses this has “just been out of the question due to their cost in both time and money,” according to Zimmerman. “That’s why the state creating an environment where businesses can easily provide retirement benefits is so important and why small businesses are central to the solution of this retirement crisis.”

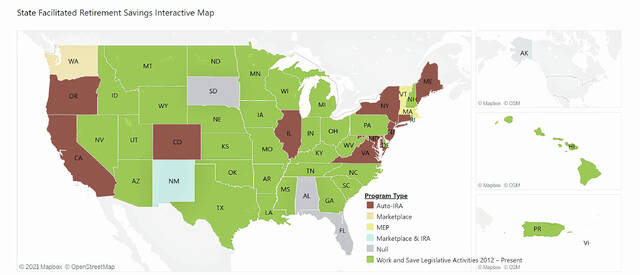

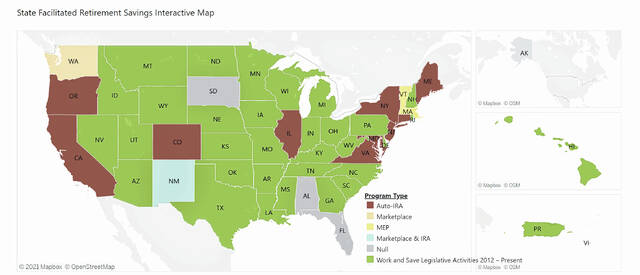

John, author of the book “Wealth After Work,” said, “People need some sort of assistance. They best way to do that is through payroll deduction where people can save consistently.” To assist with this, other states have initiated novel retirement savings programs. For example, in Oregon, Illinois, and California, “Automatic IRA” programs enable savings when small businesses do not offer any other form of retirement or pension plans.

Antonelli, who regularly contributes to Forbes and Marketwatch.com, noted that currently 1 in 5 elderly households in the U.S. rely on Social Security for more than 90 percent of their income in retirement, resulting in very low median incomes in this age demographic. Over the next 20 years, she explained, Ohio’s population over the age of 65 will grow by 12 percent and nationally it will grow by 32 percent. This amounts to a large problem that policymakers cannot ignore.

“There are significant budgetary and economic consequences to a poor aging population,” Antonelli said. Namely, the strain on resources like Social Security, Medicare, Medicaid, and other services that help provide energy, transportation, and food to the elderly. “These retirement savings initiatives are a simple, easy, low-cost way that, with state leadership, can help address this huge challenge that we face.”

Sprague said his goal is serving Ohioans as a “bold innovator” and a “wise investor.” He cited several existing programs that can also help Ohioans prepare for retirement.

• ResultsOHIO (tos.ohio.gov/resultsohio), uses successful private sector pilot projects that prove successful in advance of public sector implementation.

• The Ohio Treasurer’s Office’s Compass Award recognizes organizations, programs, and individuals engaged in empowering Ohioans through financial literacy education.

• A “Financial Literacy Resource Guide” is also available through the Treasurer’s Office (tos.ohio.gov/retirement).

• “Real money. Real world” (RMRW), created through the Ohio State University Extension (realmoneyrealworld.osu.edu), is a program that uses spending simulations where students make spending decisions, including saving 5 to 7 percent of their income, and learn about compounded interest.

• STABLE accounts (stableaccount.com), tax-free savings accounts for individuals living with disabilities, permit investing for the future without impacting benefits.

Sprague’s actions have helped underscore AARP’s efforts in adult financial literacy by emphasizing the importance of saving for retirement and how to access safe and reliable tools for financial planning.

Learn more about AARP’s efforts and what’s at stake for Ohioans by visiting www.aarp.org/ppi/state-retirement-plans/retirement-savings-gap and www.aarp.org/ppi/state-retirement-plans.