SIDNEY — The year 2018 was an exciting one for the Shelby County Treasurer’s office.

“I completed my first full year in office and we made a number of changes to make the office more productive. By embracing technology, we are able to work smarter and more efficient resulting in better service to the citizens of Shelby County,” said Shelby County Treasurer John Coffield.

His report continus:

One of the things we were able to accomplish was negotiating a lower rate that our credit card paying customers pay. That rate has been lowered from 2.95 percent to 2.40 percent. However, the thing we are most excited about is the capability to make your real estate tax payments online through our website. We are currently in negotiations with a third party vendor to offer this service in the very near future. Not only will taxpayers be able to pay by credit card but they will also have the option to initiate an E-check. This will allow payments to be directly deducted from a person’s checking account. The expected fee for this service is only $1.50.

For many people, taxes are down slightly from last year. We mailed out over 25,000 real estate tax notices on Jan. 9, 2019, and first half taxes totaling more than $24,000,000 were due on February 14. Second half taxes will be due on July 20 and you should get your bills by the middle of June. It is important to pay your taxes prior to these dates to keep from being charged penalties and interest. If you have not yet paid your first half taxes, I would urge you to contact this office at once to see what we can do to assist you.

While past due accounts are not a major problem, we do intend to take a tougher stance with regards to people who are seriously past due on their tax bills. We understand that people run into financial difficulties, and we want to work with everyone to help them through rough times, but we cannot accept people ignoring their obligations.

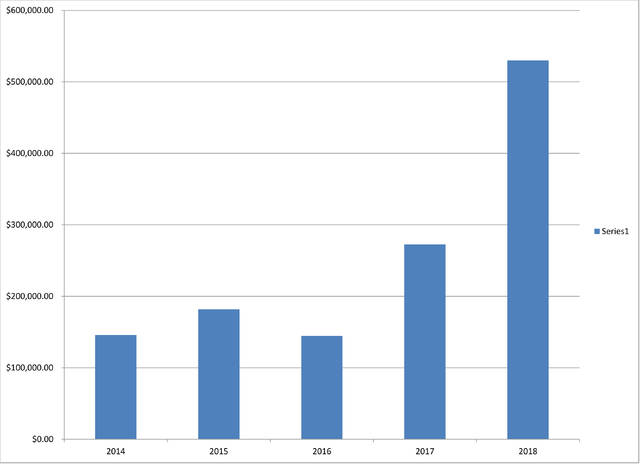

During the past year, the Federal Reserve raised interest rates four times. Due to the various investment instruments that the county is allowed to invest excess funds in, we were able to substantially increase our interest income over 2017 … and what was budgeted for 2018. In 2017, our interest income was $272,000. For 2018, that amount came to just shy of $530,000. By wisely investing county money, we are able to provide additional services to the people of Shelby County without using money from taxes. We are hoping to continue this upward trend in increased interest income for 2019.

The Treasurer’s office is also heavily involved with the Shelby County Land Reutilization Corporation, also known as the Land Bank. This has also been a busy year for the Land Bank. You will find a more detailed explanation from our Executive Director Doug Ahlers elsewhere in the Progress Edition.

Our office will continue to help all taxpayers in any way we can. Hours of operation are 8:30 a.m. to 4:30 p.m. Monday through Thursday and 8:30 a.m. to noon on Friday. Our website is www.shelbycountytreasurer.com and our main phone number is 937-498-7281. Please do not hesitate to contact us with any questions or concerns that you may have. We hope you have a great 2019.